It’s the Season of Giving! You can help raise money this holiday season by using GreenLeaf Bank digital services. This November and December we'll make a $1 donation to these charities every time you make a digital transaction:

Doing good with Operation Gratitude.

Operation Gratitude is a nationwide nonprofit whose mission is to lift spirits and say thank you to our military and first responder communities while honoring their service by creating opportunities for all Americans to express their gratitude through hands-on volunteerism.

Learn more about Operation Gratitude

https://www.operationgratitude.com

Doing good with Good360

Good360 exists to close the need gap by connecting businesses with brand-new, unsold goods to people in need, creating a circle of good where everyone benefits.

Learn more about

Qualifying Transactions Include:

Once again, beginning November 1, GreenLeaf Bank is partnering with area food pantries to collect donations for local residents in need. For each item donated to the food drive, GreenLeaf Bank will donate an additional $1 to assist the pantry! Wrightstown and Greenleaf offices are collection sites during the month of November. Drop off donations at either office.

Help us stock area pantry shelves for Christmas. Thank you for your consideration and generosity!

List of items needed:

Canned Soup

Canned Vegetables

Canned Stew

Pasta

Rice

Cereal

Pancake Mix and Syrup

Oatmeal

Breakfast Bars

Canned Fruit

Granola

Juice Boxes

Canned Tuna or Chicken

Peanut Butter and Jelly

The River Coffee and Cream is a wonderful community gathering place in the central retail district in the Village of Wrightstown. Its riverfront location will be enhanced with a new expansion, allowing The River to host private and community events and to provide more seating. The expansion, which will be complete this fall, was aided through a $30,000 grant provided to the project by GreenLeaf Bank through its partnership with the Federal Home Loan Bank of Chicago. FHLBank Chicago offers grants of up to $30,000 to eligible small businesses to advance economic opportunity in the communities it serves.

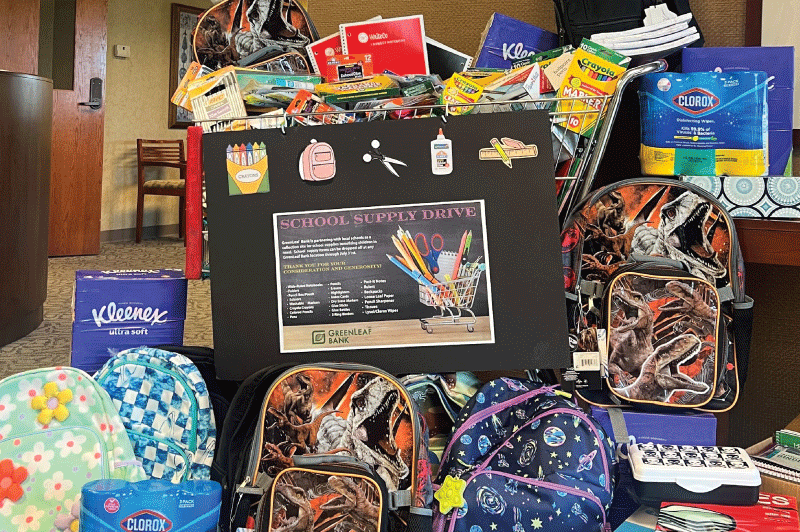

GreenLeaf Bank completed their summer School Supply Drive to benefit area children in need. Local residents came through donating an overflowing shopping cart full of supplies. Donations included backpacks, binders, folders, notebooks, markers, highlighters, pencils and pens. These generous donations from our friends and neighbors help students get their school year off to a great start.

Donations were received at both bank offices and supplies will be distributed by the Wrightstown School District.

Thank you to everyone who donated.

Once again GreenLeaf Bank is partnering with local schools to collect supplies to benefit area children in need. School supply items can be dropped off at either GreenLeaf Bank location beginning July 1 through the 31st .

Thank you for your consideration and generosity!

Here is a list of needed items:

GreenLeaf Bank hosts a Jeans Day fundraiser on the first Friday each month. Staff wear jeans for a $5 donation to local charities. GreenLeaf Bank then matches their donation. The most recent recipient Mary’s Missions, Inc. is a nonprofit, 501(c)(3) organization working on behalf of the homeless, veterans, and Native American women & children.

Pictured here Mary Ehnerd accepts a $740 check from bank Director of Strategic Partnerships Michael Krutz.

Thanks to bank staff for contributing to a successful event. Thanks also to everyone who contributed by purchasing a brat or burger! Here team members Scott and Steve work the hut while Bob grills burgers and brats.

On Friday, June 7th, GreenLeaf Bank will be hosting a brat fry fundraiser at Dick's Family Foods in Wrightstown. All proceeds will be donated to Tiger Strong Sting Cancer.

Stop by the booth between 10:00 am and 1:00 pm to order brats, hotdogs, or hamburgers for $3.00 or cheeseburgers for $3.50.

For more than 25 years GreenLeaf Bank has supported local high school graduates by awarding four $500 scholarships to Wrightstown High School seniors. The scholarships were accepted at Wrightstown High School’s award ceremony May 22nd. The awards can be used for higher education at a college, university, or technical school. Michael Krutz (left) presented the scholarships to this year’s recipients:

Benjamin Zemple

A.J. Leung

Amber Radtke

Charles Garvey

Congratulations and good luck to all 2024 graduates!

We are pleased to announce GreenLeaf Bank will once again award four – $500 scholarships to high school seniors graduating in the spring of 2024. The scholarship can be used for college, university, or technical schooling.

Eligible students will be graduates of an area high school, complete the scholarship application, provide school transcripts and provide a written essay. The deadline for submission is Friday, April 12.

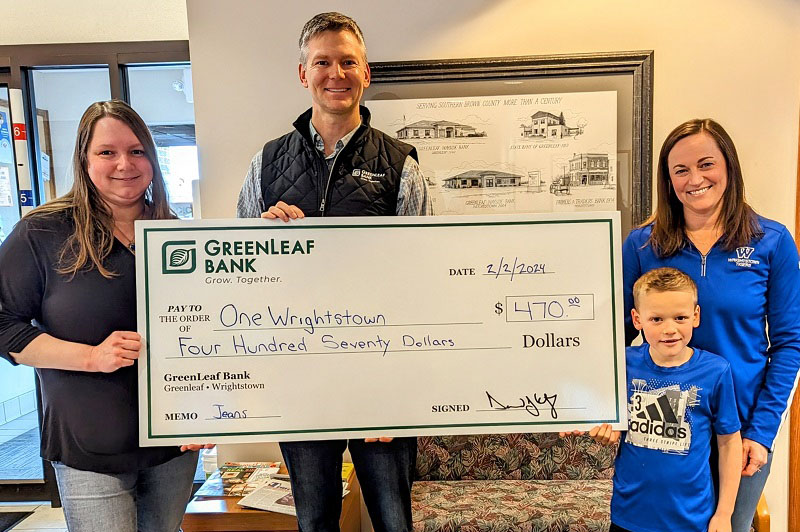

GreenLeaf Bank hosts a Jeans Day fundraiser on the first Friday each month. Staff wear jeans for a $5 donation to local charities. GreenLeaf Bank then matches their donation. The most recent recipient, One Wrightstown, received $470!

One Wrightstown provides essentials such as boots, jackets, backpacks as well as emergency shelter needs, etc to families who do not have the means.

Joining GreenLeaf Bank staff Jennifer Gay (left) and Michael Krutz (next) is Jenny Vander Zanden (One Wrightstown board member) and her son.

U.S. Department of Agriculture (USDA) announced a $420 million fund for projects invested in local and regional food systems. The Wisconsin Department of Agriculture, Trade and Consumer Protection (DATCP) will award $27 million in grant funding. Successful projects expand capacity and infrastructure for processing, manufacturing, storing, transporting, wholesaling, and distribution of locally and regionally produced food products, including crops, dairy, grains for human consumption, aquaculture, and other value-added food products.

• Expand processing capacity and distribution of agricultural products to create more and better producers.

• Modernize manufacturing, tracking, storage, and information technology systems.

• Enhance worker safety through adoption of new technologies.

• Improve training opportunities.

• Support construction of a new facility.

• Modernize or expand an existing facility.

• Construction of wastewater management structures.

• Modernize processing that reduces greenhouse gas emissions, increases efficiency in water use,

Wisconsin RFSI Program applicants can access Request for Proposals Full proposals for both tracks are due by 5 p.m. on Wednesday, March 6, 2024.

Resilient Food Systems Infrastructure Program details

Or, call a GreenLeaf Bank Lender: 920-864-7901

On Monday December 11th we’re launching a new mobile banking app to replace the existing TouchBanking app. Current TouchBanking users will be directed to the app store to download the new app when signing in on or after December 11, 2023.

Users can also download the new GreenLeaf Bank mobile app on Dec. 11th by visiting the App Store for Apple products or Google Play for Android. Once the new GreenLeaf Bank app is on your phone, just login with your current username and password. It’s that simple!

Keep your finances at your fingertips with the GreenLeaf Bank mobile banking. You can easily:

Follow these simple steps to get started:

Search for the “GreenLeaf Bank” app in the Apple or Android store and download.

Thank you to everyone who has donated to our November Food Drive to benefit the Wrightstown Area Food Pantry. We have collected over 400 food items to stock the pantry shelves. And because of YOU, GreenLeaf Bank has donated an additional $426.00 to the food pantry for future purchases.

By using your GreenLeaf Bank digital services this holiday season two charities Good360 or Operation Gratitude will receive up to $50,000 . For every qualifying transaction you make, $1 is donated. GreenLeaf Bank digital banking products include:

• Pay bills online

• Make a new transfer

• Send money with Zelle®

• Enroll in mobile banking

Local residents came through donating several shopping carts full of supplies. Donations included backpacks, binders, folders, notebooks, markers, highlighters and writing instruments. These generous donations from our friends and neighbors help students get their school year off to a great start.

Donations were received at both bank offices and supplies will be distributed by the Wrightstown School District.

Thank to everyone who donated.

Once again GreenLeaf Bank is partnering with local schools to collect supplies to benefit area children in need. School supply items can be dropped off at either GreenLeaf Bank location now through August 7th.

Thank you for your consideration and generosity!

Here is a list of needed items:

• Wide-Ruled Notebooks

• Folders

• Pencil Box/Pouch

• Scissors

• Washable Markers

• Crayola Crayons

• Colored Pencils

• Pens

• Pencils

• Erasers

• Highlighters

• Index Cards

• Dry Erase Markers

• Glue Sticks

• Glue Bottles

• 3 Ring Binders

• Post-It Notes

• Rulers

• Backpacks

• Loose Leaf Paper

• Pencil Sharpener

• Tissues

• Lysol/Clorox Wipes

As a Community Bank, we have the duty to support our community, and for over 25-years GreenLeaf Bank has awarded scholarships to area students. Here Michael Krutz (left) recognized this year's recipients at a ceremony at Wrightstown High School.

Recipients in order are:

Joseph Uitenbroek

Conner Born

Danielle Bruecker

Leah Uitenbroek

Congratulations to all 2023 high school graduates!